perfect competition

| The assumptions of perfect competitions | - the industry is made of a very large nmber of firms - each firm is so small that they have no effect on the market if they change output - all the firms produce homogenous products - firms are completly free to enter and leave the market as they choose. -all producers and consumers have perfect knowledge of the market Good example is agricultural | |

| Profit maximimization | | |

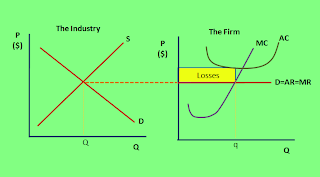

Possible short run profit and loss | Short run abnornmal profits  Short run losses | |

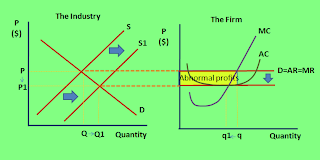

| Short run abnormal profits to long run norma

| | |

| Short run losses to long run normal profits | | |

| Long run equilibrium in perfect competion | | |

| Productive and allocative efficiency in perfect competition

| | |

| Allocative efficiency

•Allocative efficiency (the socially optimal level of output) occurs where suppliers are producing the optimal mix of goods and services required by consumers. •Price reflects the value that consumers place on a good and is shown on the demand curve (average revenue) •Marginal cost reflects the cost to society of all the resources used in producing an extra unit of a good, including the normal profit required for a firm to stay in business. •Allocative efficiency occurs where marginal cost (the cost of producing one more unit) is equal to average revenue (the price received for a unit). •MC=AR [allocatively efficient (socially optimal) level of output] | | |

| Productiove and allocative effeciency in the short run in perfect competition | | |

| Productive and allocative efficiency in the long run in perfect competion | | |

| |

l profits

l profits